Emirates Islamic NOL Card Benefits & Price 2026

The Emirates Islamic RTA Nol Card is an all-in-one solution for frequent commuters and shoppers. It combines the convenience of Dubai’s Nol transportation system with a rewards program, providing an easy way to pay for travel, fuel, and purchases while earning benefits for everyday spending.

Table Of Content

Emirates Islamic Nol Card Benefits

You can check the benefits of obtaining Emirates islamic Nol card, as follows:

- 10% cashback on fuel purchases with a maximum of AED 75 per month.

- 10% cashback on RTA payments with a maximum of AED 75 per month.

- Up to 2.25% on international spends, up to 1.25% on local spends, and 1% cashback on domestic grocery and supermarket purchases.

- Integrated Nol Card for seamless transit and parking payments.

- Auto top-up for Nol card when the balance drops below AED 20.

- Salik auto top-up when the balance falls to AED 20 or less.

- Purchase protection coverage up to USD 5,000 for stolen or damaged purchases.

- Extended warranty providing an additional year on the manufacturer’s warranty.

- Buy 1 Get 1 free on up to 2 cinema tickets per month with a minimum spend of AED 3,000.

- Emergency assistance services, including global medical, legal, and emergency cash advance support.

Read more: How to Apply for Student NOL Card | Blue NOL Card Benefits & Price | Gold NOL Card Price & Benefits | Silver NOL Card Benefits & Price | What is the Minimum Balance in NOL Card | NOL Card Recharge Machine Near Me

Emirates Islamic Nol Card Price

The table below shows Emirates islamic Nol card and all the fees:

| Service | Fees |

| Annual Fee | AED 299 (waived for the first year with specific promotions). |

| Supplementary Card Fee | Free. |

| Interest Rate | Varies based on the type of transaction and repayment schedule. |

| Cash Advance Fee | 3% of the withdrawn amount or AED 105, whichever is higher. |

| Foreign Currency Markup Fee | 2.99% of the transaction amount. |

| Over-limit Fee | AED 288.75. |

| Late Payment Fee | AED 241.50. |

| Balance Transfer Fee | Subject to promotional offers (check with the bank). |

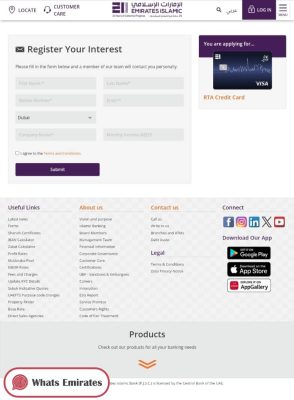

How to Apply for Emirates Islamic Nol Card

You can apply for Emirates islamic Nol card through Emirates Islamic official website, by following these simple steps: [1]

- Go to Emirates Islamic website for the RTA Credit Card “from here”.

- Scroll down to Cashback Cards.

- Click “Apply Now” for RTA Nol card.

- Provide your personal information, including the following:

- Name.

- Phone number.

- Email address.

- Emirate.

- Company name.

- Monthly income.

- Check the terms and conditions agreement box.

- Click “Submit”.

- Wait for a representative to contact you for further assistance.

Emirates Islamic Nol Card Applying Link

You can apply for Emirates Islamic Nol card through Emirates Islamic official website through this link emiratesislamic.ae after providing all the necessary information about the applicant and submitting the application.

Read more: RTA Nol Card Balance Check Online | How to Recharge NOL Card Online | How to Check NOL Card Balance in Mobile| How to Pay NOL Card Online: All Ways | RTA NOL Card Expiry Check Online | NOL Card Unlimited All Zones Price

Conclusion

The Emirates Islamic RTA Nol card combines convenience, rewards, and savings in one card, perfect for daily commuters and frequent shoppers. With its cashback benefits and integration into Dubai’s Nol system, it offers a seamless experience, ensuring smarter spending and added value for every transaction.

Questions & Answers

The Emirates Islamic RTA Nol Card is a versatile card offering rewards on public transport, fuel, and shopping. It functions both as a credit card and a Nol card for easy use on Dubai's transportation network.

No, it can be used for payments at stores, restaurants, fuel stations, and public transport, making it ideal for everyday purchases.

Yes, you can redeem points earned through the card via online banking or the mobile app, with a minimum redemption of 300 points.

Cashback varies depending on your spending, but you can earn up to 10% cashback on transportation and fuel payments.

Yes, the card supports international transactions and offers up to 2.25% cashback on unlimited international purchases.